APR stands for annual (or annualized) percentage rate. It is the percentage of interest that is charged for debt accrued.

About Your APR

Defined as a percentage, the APR on a credit card is used to calculate the total cost of borrowed funds. Outstanding balances accumulate very quickly if they are carried for an extended amount of time since interest is assessed each billing cycle. This means that any unpaid interest and principal continues to roll over into subsequent months until the balance is completely eliminated. Also, keep in mind that the figure used to calculate the monthly interest also includes other miscellaneous fees associated with transactions such as cash advances and late payments.

Average APR

The average APR on credit cards is close to 14%. Various factors, including your credit history, affect what rate you will qualify for. Generally, those individuals with strong ratings are offered lower APRs. On the other hand, newbies to the credit world or those with an unfavorable credit file are more of a risk. Therefore, creditors tend to protect themselves by offering steeper rates. The APR for these cardholders can reach up to 25%.

Types of APR

The three primary forms of APRs are fixed, variable and tiered. Fixed rates are generally available to debtors with a good credit rating, and remain constant for the life of the account unless the federal interest rates increase. If this occurs, creditors are required to notify cardholders prior to making any adjustments. Also, the increased rate is usually only applied to debt accrued after the increased rate goes into effect. On the other hand, variable rates can fluctuate on a daily basis, and the debtor will not be aware of the forthcoming change. Tiered APRs are determined by the tier that the balance falls into.

How APR Affects Your Bill

Take a look at how three different APRs affect the total repayment amount on a $1,000 balance if only the minimum payment of $20 is remitted monthly.

Rate |

Length of Repayment |

Total Interest Paid |

Total Amount Paid |

|---|---|---|---|

| 4% | 4.6 years | $96 | $1,096 |

| 14% | 6.3 years | $510 | $1,510 |

| 23% | 14 years | $2,348 | $3,348 |

As evidenced by the chart, APR is a major element of any credit card and should not be ignored. Keep in mind that these figures do not consider future purchases, which increase the overall interest paid to the creditor. A high interest rate coupled with only making the minimum payment will result in a very long period of time -and plenty of interest payments- before the debt is paid in full.

Other Considerations

Often, credit cards assess higher APRs for non-standard transactions such as cash advances and late payments. It is important to make timely payments as the default APR for late payments is usually a lot higher than the original rate and your credit score can be adversely affected, potentially causing you to only qualify for high interest rates in the future.

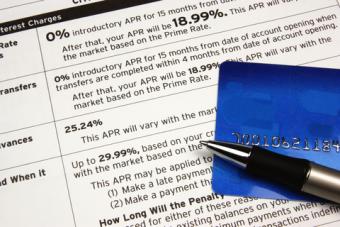

Credit card companies also offer low introductory rates ranging from 0% to 4% percent for four months to one year. These are used to attract more customers. Be sure that you are aware of the expiration date of the promotional offer prior to using the credit card.

Where Can You Find the APR?

The APR associated with your credit card can be located on both the print and online statement, via telephone by calling the company or on the creditor's website.

Which Card Is Right for You?

Every cardholder has varying personal preferences, so the selection process will not be the same for each individual. However, the APR should weigh heavily on the decision. The grace period, which is the amount of time between billing cycles, should also be considered.

Don't fall into the insomniac interest trap that buries debtors every day. Instead, be well aware of the APR on each credit card you select and always read the fine print to understand the terms and conditions and avoid paying more in interest than you initially bargained for.